Scaling Africa’s entrepreneurs: Insights from Sankalp Africa 2025

A major conference on scaling innovation took centre stage in the Kenyan capital Nairobi at the end of February, uniting more than 1,500 innovators, investors, and thought leaders around the central theme of “Scaling Africa’s entrepreneurs.” Organised by Energy Catalyst’s delivery partner Intellecap, the summit ignited vibrant discussions on harnessing entrepreneurial talent to address Africa’s most pressing challenges, including food insecurity, climate vulnerability, and gaps in healthcare and education provision.

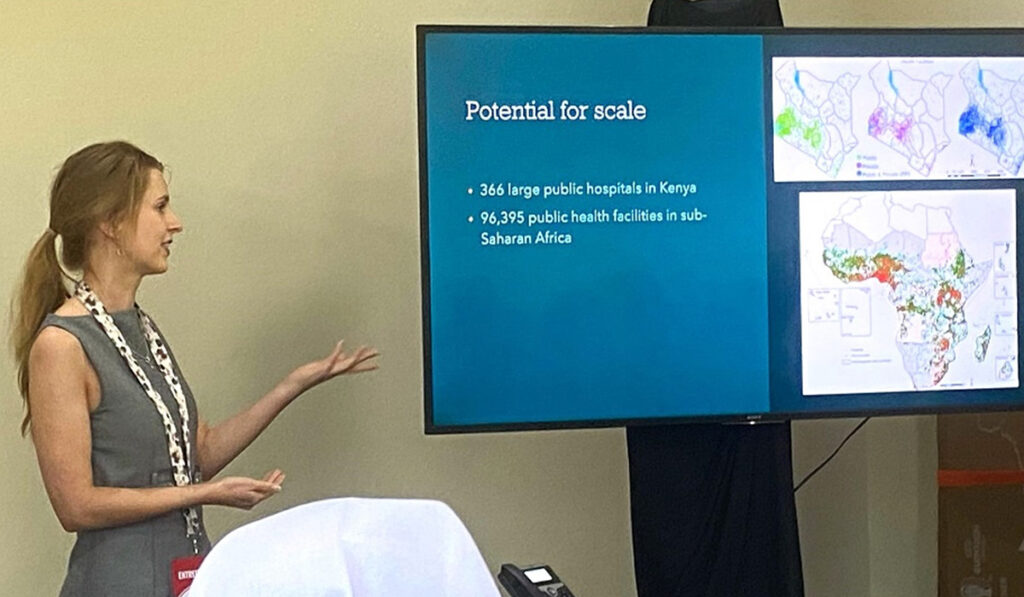

Participating as a key knowledge partner, Energy Catalyst and its commitment to fostering robust, strategic partnerships, nurturing local market ecosystems, and championing contextually relevant energy transition solutions, aligned seamlessly with the summit’s focus on scaling innovation to address key challenges in the region. The delegation showcased nine companies: NjordFrey, Mandulis Energy, GreenPower Overseas, Hubl Logistics, Africa Power, Agsol, Open Energy Labs, SHIELD, and Direct Impact Partners. These innovators capitalised on the opportunity to highlight their pioneering solutions, forge connections with potential investors, and cultivate strategic partnerships with fellow changemakers.

The summit’s opening plenary spotlighted Africa’s critical capital needs, with leaders from the African Development Bank (AfDB) and The Rockefeller Foundation amongst those celebrating Africa’s burgeoning entrepreneurial culture. Several speakers highlighted how the continent’s young demographic, rapid urbanisation and abundant natural resources are helping to power innovation across a range of sectors including agribusiness, renewable energy and financial technology. Whilst financing undoubtedly remains critical, accelerating innovation will also depend on collaboration. In that spirit, AfDB unveiled a new digital platform designed specifically for African entrepreneurs, which will provide market intelligence, networking opportunities, and funding resources. Whilst the outlook for African entrepreneurs is bright, some speakers noted that capacity building and ecosystem development are likely to remain necessary until private sector companies are in a stronger position to thrive without support.

Energy Catalyst hosted an engaging panel entitled “Localising the global: Adapting climate innovations to Africa’s unique needs,” which explored the imperative of tailoring clean energy solutions to Africa’s distinct socioeconomic, cultural, and environmental contexts. The session began with speakers from SHIELD, Mandulis Energy and NjordFrey showcasing how their solutions have been adapted to local environments. For example, Faisal Razzaq from NjordFrey described how the company’s sophisticated aquaponic farm model — capable of cultivating 100 varieties of crops and fish — was informed by extensive research into food cultures in Rwanda. Aiming to enable smallholder farmers to achieve higher incomes and food security, this project exemplifies Energy Catalyst-funded innovations refined through a nuanced understanding of local practices and preferences.

The subsequent panel discussion brought together innovators, investors and support providers to share perspectives on developing locally relevant solutions. Participants emphasised how building local partnerships gives companies deeper insights into consumer behaviours, which helps ensure their solutions achieve lasting impact. Victor Ndiege from Kenya Climate Ventures identified the need to expand in-country capital sources, noting local investors possess superior insight into local market conditions, and made the case that development programmes should align technical assistance (TA) to their specific investment criteria. Karen Runde from the Miller Center, an accelerator for social enterprises, discussed the pivotal role of acceleration programmes, like Energy Catalyst, in bridging cutting-edge innovation and localised implementation strategies. Their expertise in local supply chains and market dynamics is often crucial when it comes to guiding the scaling journeys of entrepreneurs, and that in-depth country knowledge can also enable them to advocate more effectively for reforming policy to fuel market growth.

Gender equity emerged as a central focus during the plenary on the second day, with representatives from the Women Entrepreneurs Finance Initiative and The Africa Enterprise Challenge Fund addressing the persistent investment gap faced by women entrepreneurs. Women-led businesses received a mere 1% of startup funding in 2024, so require a far greater magnitude of investment to unlock their full potential to create jobs, generate wealth and foster socio-economic development. Discussions explored actionable strategies to stimulate investment in women-led ventures, including devising comprehensive impact frameworks, amplifying the stories of female founders, and strengthening collaborations between investors, development institutions, and incubators which champion gender equity. Participants also emphasised the importance of capacity-building initiatives designed to help small, informal women-owned businesses transition into higher-margin sectors and access formal financing channels.

Energy Catalyst also hosted an investor-focused roundtable to understand their requirements in greater depth, which also informs the support provided by TA programmes to SMEs on investment readiness. Highlighting the difficulties they face in identifying appropriately sized companies with profitability potential in challenging markets, investors outlined their selection criteria when assessing projects. These included strong company governance, a defined long-term strategy, a robust business model, well-designed impact measurement frameworks, and track records in building local partnerships and a base of loyal customers. Consequently, project leaders gained valuable insights on how to better align future investor pitches with these priorities.

Reflecting on the summit, Tsvetina Chankova from the Carbon Trust, who co-led the delegation, observed: “The emphasis on scaling innovation by supporting entrepreneurialism resonated deeply with our delegation. While increased financing clearly remains essential for achieving scalability, it was great to witness such a powerful emphasis on collaboration as an engine for progress. Through the panel session and investor roundtable, we also reflected deeply on the need for greater understanding of local contexts, which increases the relevance of our solutions and support. During an uncertain period for climate finance, this commitment to equipping entrepreneurs with tailored tools and connections for resilience offers a path forward.”